Do you have a low credit score? Have you ever checked? A recent study found that 56% of Canadians have never checked their credit score.

A low credit score can prevent you from getting a lease for a car or mortgage. It can even prevent you from leasing rental housing.

But that doesn’t mean you’re stuck with bad credit forever. There are steps you can take to improve your credit score.

Keep reading to learn how to improve credit to make big decisions a little easier.

How Do Credit Scores Work

Your credit score is a number that represents your creditworthiness. Lenders use it to decide whether to give you a loan and what interest rate to charge you. Good credit scores can get you the best interest rates on loans.

A low credit score means you’re a high-risk borrower, leading to higher interest rates and difficulty getting a loan. Most lenders won’t accept your application if your score is lower than 600 – 650.

The credit score range in Canada is as follows:

300-559: Poor

560-659: Fair

660-724: Good

725-759: Very good

760 and up: Excellent

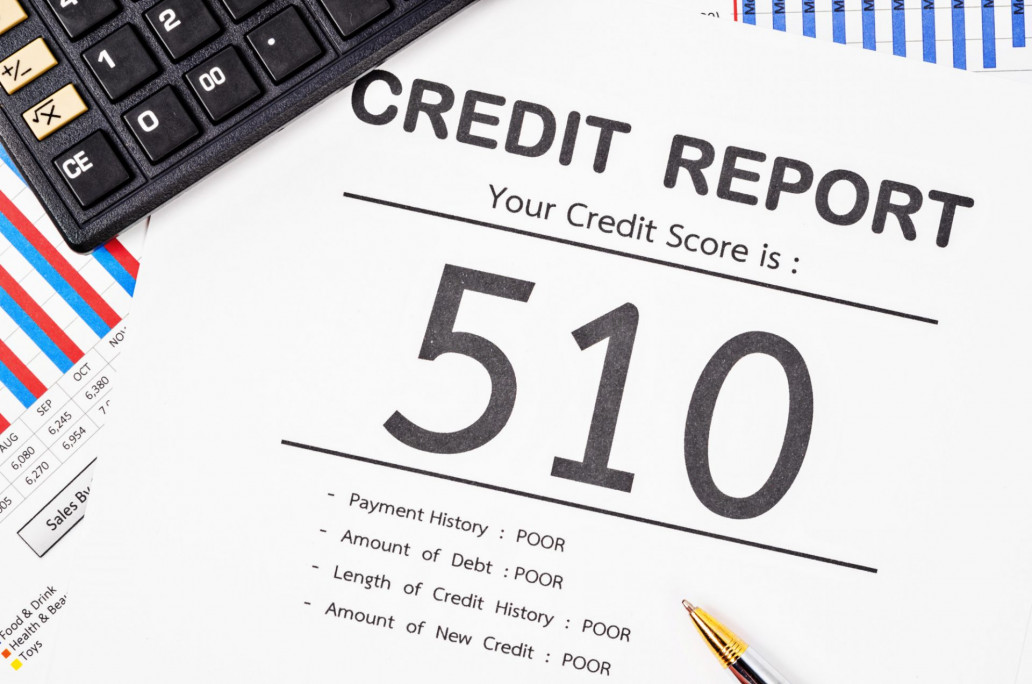

Factors That Affect Credit Scores

Your credit score is based on information in your credit report. Your credit accounts include all the lines of credit you have, like credit cards, loans, and leases.

Creditors like to see at least three lines of credit on your report. This shows you can manage different types of credit responsibly.

The five main factors that affect your credit score are:

Payment History

Your payment history is the most significant factor in your credit score. It includes whether you’ve made all your payments on time, missed any, or made late payments. Lenders want to see a history of on-time payments.

Credit Utilization

This is the amount of credit you’re using compared to your credit limit. It’s essential to keep your credit utilization low. It should be kept below 30% to maintain a good credit score.

Credit History

Your credit history is the length of time you’ve had credit accounts open. A long credit history with no late payments will help improve your score. A short credit history with late payments will lower your score.

Credit Mix

A mix of different types of credit, such as credit cards and loans, can help improve your score. The types of credit you have make up 10% of your score.

New Credit

Opening new credit accounts can lower your score, especially if you open several in a short period. If you’re planning on applying for a loan, avoid opening new credit accounts beforehand.

What a Low Credit Score Means

If you have low credit, you are considered a high-risk borrower.

It will be harder to get approved for loans and credit cards. You’re also likely to pay higher interest rates if you’re approved. Creditors may need collateral or charge a higher interest rate.

A low credit score can also prevent you from getting a job, renting an apartment, or signing up for utilities. Landlords, employers, and utility companies may all check your credit score before deciding.

A low credit score can also mean that you’ll have to put down a larger deposit for loans or rental housing.

How to Check Your Credit Score

The first step to improving your credit is to check your credit score and credit report. You’re entitled to a free copy of your information from each major credit bureau every year.

You can do a credit check through some credit card issuers and financial institutions. Another way to check your score is to use a credit monitoring service.

Pay Your Bills On Time

Payment history makes up 35% of your score, making it the most crucial consideration.

Late payments can stay on your report for seven years, and missing payments can last even longer. If you have any late or missed payments, try to catch up soon.

Making progress on your debt is more important than the amount of debt you have. Making minimum payments is better than missing a payment or making late payments.

Pay Down Debt

If you have low credit, one of the best things you can do is pay down your debt. This will improve your credit score and make it easier to get approved for loans and lines of credit in the future.

Try to keep your credit card balances low. Make sure you’re making progress on any outstanding loans. You can also try to consolidate your debt to make it more manageable.

Don’t Apply for Multiple Credit Lines at Once

A credit line is an amount of money that a financial institution, like a bank, extends to you. You can borrow against this line of credit up to the limit and then pay back what you’ve borrowed, plus interest and fees.

Lines of credit are different from loans, which are a set amount of money that you borrow all at once and then pay back over time.

There are two types of lines of credit: secured and unsecured. A secured line of credit is backed by collateral. Examples might be a savings account, certificate of deposit, or piece of property.

An unsecured line of credit doesn’t need collateral. But it generally has a lower credit limit and higher interest rate.

An inquiry is a record of when you’ve asked to see your credit report or when someone has requested your report to extend your credit. Inquiries stay on your report for two years but significantly impact your score after the first year.

Applying for several credit lines at once can be a red flag for creditors. It may give the impression that you’re in financial trouble or trying to access more credit than you can manage.

Get a Secured Card

A secured card is a credit card backed by a deposit you make upfront. The deposit is equal to your credit limit. For example, if you have a $200 deposit, you’ll have a $200 credit limit.

This card can help you build or rebuild your credit. It reports your activity to the major credit bureaus. Make on-time payments and keep your balance low to improve your credit score.

Keep Your Balances Low

Credit utilization is the ratio of your credit card balances to your credit limits. It’s expressed as a percentage, so if your credit limit is $1,000 and your balance is $500, your credit use would be 50%.

Keep your credit use below 30%. This shows creditors that you’re using your credit responsibly and not maxing out your cards.

If your credit use is high, try to pay down your balances below 30%. You can also ask your issuer for a credit limit increase. This will lower your credit use ratio without requiring you to change your spending habits.

Don’t Pay Off All Your Debt

While it’s important to pay down your debt, you don’t want to pay it all off. A good credit score requires various types of credit, including revolving (credit cards) and installment (loans).

If you have debt from a student loan or mortgage, focus on making regular, on-time payments. You don’t have to pay off the debt all at once, but you should try to pay more than the minimum due each month.

Paying down your debt is a good idea, but don’t close credit line accounts if you pay them off. A significant factor in credit scores is the length of your credit history. So, even if you don’t use the account, keeping it open can help your score.

It is better to maintain a balance under 30% than completely pay off the credit line. Creditors want to see that you can manage your credit responsibly, including maintaining a low balance.

Become an Authorized User

If you have a friend or family member with good credit, you can ask to be added as an authorized user on their account. This will give you access to their credit line, which can help you build your credit.

As an authorized user, you’ll get your own card to use. But the account will appear on your credit report. Use it sparingly and make sure that you make all payments on time.

Authorized users usually don’t have to pay any fees. But there may be some costs for the primary account holder, so be sure to ask about that before getting started.

Dispute Errors on Your Score

If you find errors on your credit report, you can dispute them with the credit bureau. This process can be time-consuming, but it’s worth it to ensure that your credit report is accurate.

The credit bureau must investigate your claim. If they find it in error, they’ll update or remove the disputed information.

You can dispute errors on your credit report online, by mail, or by phone. You can file a dispute with Equifax or TransUnion.

A Low Credit Score Doesn’t Have to Be Permanent

Improving your low credit score takes time and effort, but it’s worth it. With patience and the right strategy, you can improve your credit score and get back on track.

But we know that sometimes, life happens. If you have a financial emergency, you can apply for instant loans with bad credit from Credito. While these loans won’t help you build your credit, they can provide the cash you need to cover unexpected expenses.

If you have bad credit, you can still get a same-day loan. You can apply either online or over the phone. Head on over to our website to learn more about how we can help you. We’re here to help you get the cash you need when you need it.