When the pandemic hit in 2020 and normal life came to a standstill, Canadians were able to save over $5,500 that year. This was a huge increase from just under $500 in 2019.

It’s easy to save up when your life is on pause. But how can you keep putting money into your savings account after everything opens up and you resume your regular lifestyle?

Read on for 10 budgeting tips every young adult should know!

1. Find Out Where Your Money Goes

Chances are, you’re just winging it for your finances. So long as you earn more than you’re spending, that should be fine, right?

But there might be some things that are silently adding up that you have no clue about. For example, buying a cup of coffee every morning on your way to work might cost just a few dollars, so you don’t think anything of it. But in reality, $3 a day works out to $90 spent every month!

So sit down, open your bank app, and figure out what you’re spending each day and on what. When you get a bigger picture of things, you’ll be able to budget better and save up more.

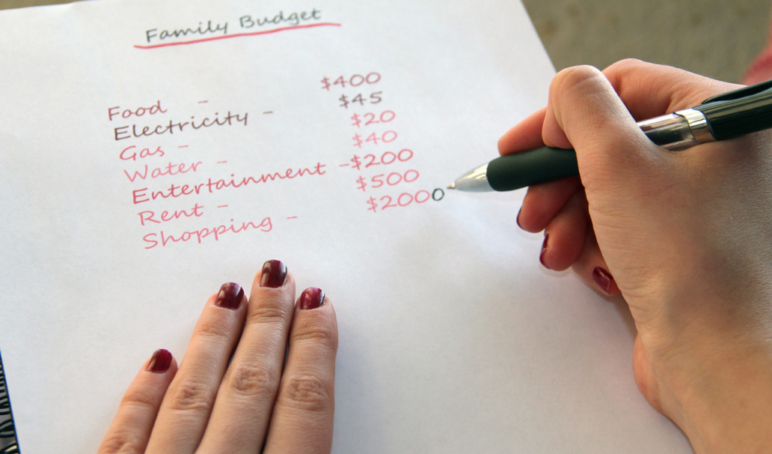

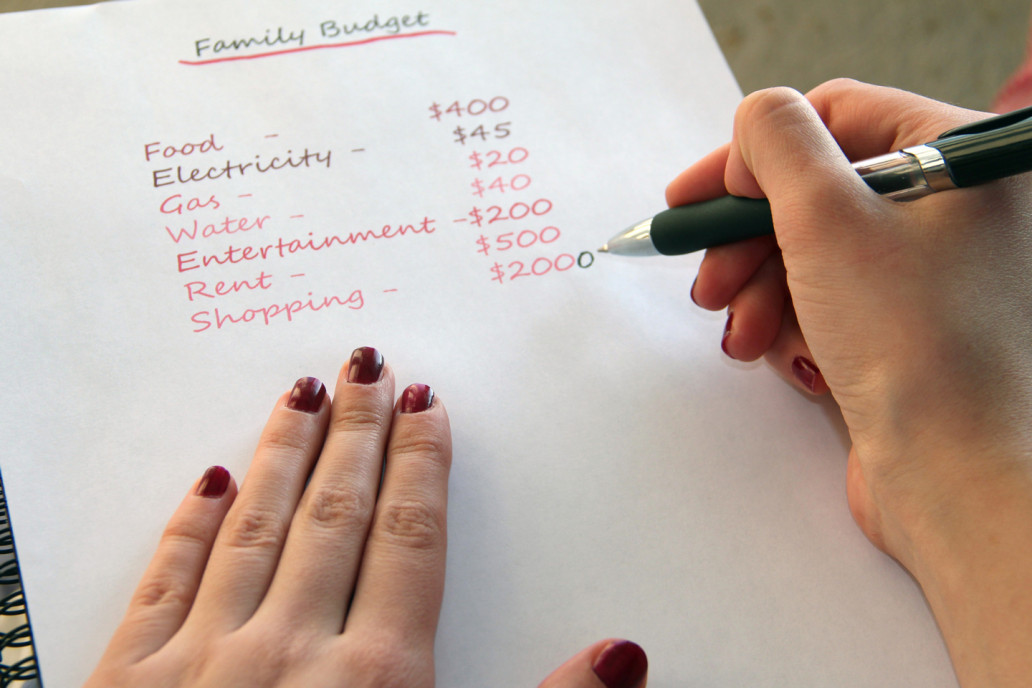

2. Set a Budget

One of the best financial tips we can give you is to set a budget, especially after you’ve completed the tip we gave above. It can be tedious to get your ducks in a row, but it’ll pay off in the end.

First, determine how much money you’re making (after taxes). Now factor in the necessities you need to pay, such as rent, utilities, groceries, etc.

Now you’re left with your disposable income. It’s likely that it’s lower than you expected, since you might not have thought about all the necessities above.

Before you go spending everything on a few nights out, you need to budget this extra money. Think about what you’d like to spend on fun activities every week, then multiply that by 4 to get your monthly “fun money” budget.

For everything else that’s left over, you can put it into your savings account so you can see that money grow.

3. Plan on Saving a Third of Your Income

While we’re on the subject of budgeting, you should aim to save at least a third of your income. If you’re already on track to do so, then great!

If not, then you’ll need to see where else you can reduce spending. If you’ve done everything possible and you’re still barely saving, then it’s time to reevaluate your job.

Are you happy where you are? Then maybe ask for a raise or promotion, especially if you’re long overdue for one.

If you’ve realized that you’re both unhappy and underpaid at your current job, then it’s time to search for a new one. Not only will you improve your mental health, but you’ll also enable yourself to save up more!

4. Start Saving for Retirement ASAP

It’s never too early to start saving for retirement, even if you’re in your early 20s. You might think this is the same thing as saving for a car purchase or a rainy day, but there’s a difference here.

To save wisely for retirement, you should contribute funds to your Registered Retirement Savings Plan (RRSP) every year. If you’re lucky, your employer will make a contribution as well, and they might offer a group tax-free savings account (TFSA) too.

A side benefit of contributing to your RRSP is it’s based on pre-tax amounts, which means you can get a huge tax break.

5. Keep Track of Your Spending

It’s one thing to set a budget, and it’s another to follow it. You’ve already done most of the hard work, so now it’s time to put your budget into practice. And to do so, it’ll take a little self-control.

As you’re making purchases daily, keep track of what you’re spending and on what. It can be helpful to download a budgeting app. It’ll be easy to record what you’ve spent money on, plus the app can categorize everything for a general overview.

Keeping track of your spending can help you determine if the budget you’ve set is realistic or not. It can also make you aware of overspending habits in certain areas, such as entertainment.

From there, you can either adjust your budget or behaviours so you’re better able to save.

6. Spend Only Cash

Do you find it difficult to stick to your budget? It’s probably because it’s so easy to swipe your cards and not think about the actual money you’re spending.

A great way around this is to spend only cash. Based on the numbers you’ve crunched above, get out some envelopes and stuff them with the amount you’re allowed to spend for each category. Then put these envelopes in your bag or purse and leave your cards at home.

When you’re out, you’ll only be able to spend from these envelopes. The physical act of taking out cash and seeing how much you’re spending will make you reconsider some purchases. Plus, when you run out, you can’t spend any more money!

7. Plan Out Meals Ahead of Time

Buying groceries on a whim can add a lot of unnecessary costs. It’s better to plan out your meals ahead of time so you know what to buy.

An even better idea is to take a look at what the grocery store has on sale each week and plan your meals around those ingredients. Write down everything you need before going to the store so you don’t forget anything and you know approximately how much you’re spending.

It also helps to shop when you’ve just eaten. If you shop while hungry, you might make impulse buys, which will make you go over budget.

Planning out and making meals can also help you budget better if you have an office job. Home-cooked food is cheaper and when you’ve planned sack lunches for every day, it’s not as tempting to eat out or buy snacks.

Meal prepping for the rest of the week can help with your budget too. When you’re too tired to cook, just pop those meals into the microwave instead of spending $20 or more on takeout.

8. Be Aggressive When Paying off Debts

Having credit cards is good for building up credit so you get better interest rates, higher amounts, and increased chances of approval when taking out loans and mortgages in the future.

But with these credit cards come high interest rates that can quickly add up. Even student loans with low interest rates can add unnecessary expenses.

The best financial advice here is to whittle down debts as much as possible, and as quickly as possible. Shorter repayment times mean less interest paid, which then equals less money paid to your lender.

9. Understand Income Taxes

The Canadian government taxes you on money made (income taxes). There isn’t just a flat rate either; there are 5 brackets and where you fall will depend on how much you make. They are as follows for 2022:

- Up to $50,197: 15%

- $50,198 to $100,392: 20.5%

- $100,393 to $155,625: 26%

- $155,626 to $221,708: 29%

- $221,709 and over: 33%

Before you start panicking, just because you fall under the 3rd bracket doesn’t mean all of your income is taxable at 26%. Instead, the first $50,197 is taxable at 15%, then the rest up to $100,392 is taxable at 20.5%, and the rest is taxed at 26%.

By understanding how income taxes work, you’ll be more prepared when it comes time to pay them.

10. Put Aside an Amount for Income Taxes

On that note, now that you know how to figure out income taxes, you should be able to calculate approximately how much you’ll owe the government. The total amount might be a daunting number, but split it across the paychecks you receive during the year.

For example, if you make $50,000 in a year, then you’ll need to set aside 15% or $7,500 for income taxes. This works out to saving a little over $144 a week, which is much more manageable than scrambling for $7,500 at the end of the year.

Use These Budgeting Tips to Save Up

By following the right budgeting tips, you’ll be able to slowly put away some extra cash at an early age. Over time, you’ll build a nest egg that’ll enable you to make big-ticket purchases, such as cars and even houses!

More importantly, you’ll have a safety net to fall back on if you ever have an emergency situation. Having your personal finances in order and that stability will be a huge relief!

If you need some financial help before getting started on saving up, then apply for a loan with us today. It’ll take less than 5 minutes and there’s no credit check!